It’s been almost 50 years1 since we launched the world’s first index fund for US investors. We still believe that including index funds in a portfolio can give investors a straightforward way to meet their financial goals.

So, what is an index fund? Both index and active funds2 can be used to gain access to a particular market, such as UK shares for example. Index funds usually compare their performance against an appropriate market index – also known as its ‘benchmark’3 – such as the FTSE All-Share. They aim to closely match (or track) the performance of the specified market index. With active funds, however, the fund manager decides which shares or bonds4 to pick, usually with the aim of outperforming a benchmark.

Which one you choose will depend on your goals and preferences. Here we discuss four reasons to consider an index fund.

1. Predictable relative returns

Because index funds aim to track the performance of a specific market index as closely as possible, their returns also tend to closely match those of the market index. By contrast, active funds aim to outperform their benchmark, so returns can differ quite significantly from those of the market.

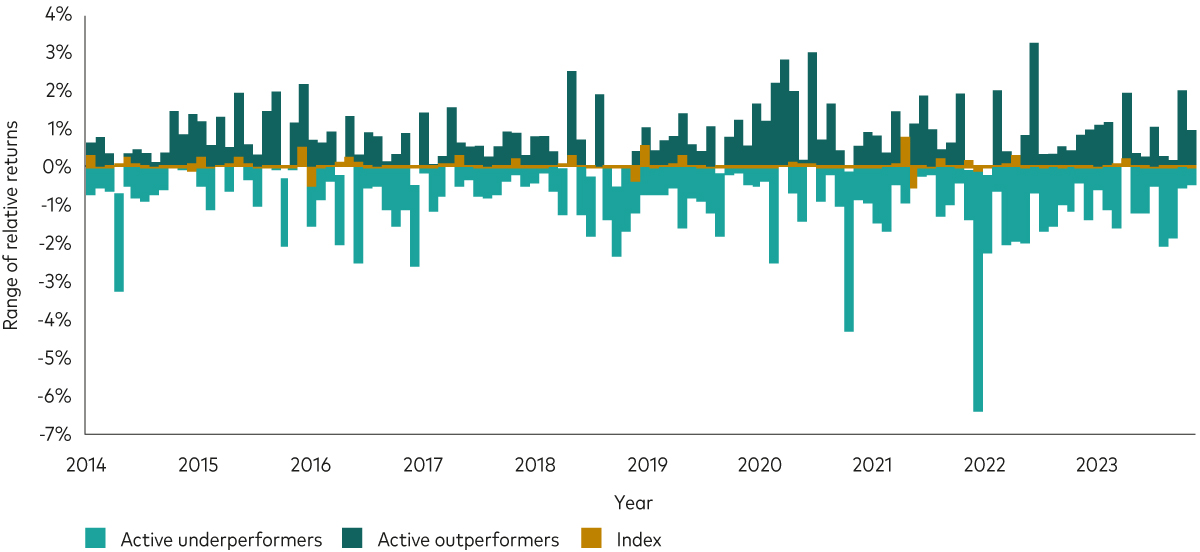

This means that the performance of active funds compared with their benchmarks is often less predictable than the performance of index funds relative to their benchmarks, as shown in the chart below.

The dark green bars show active funds investing in shares that have outperformed their benchmarks, while the light green bars show active funds that have underperformed their benchmarks. As you can see, there is a wide range of returns. Some active funds have beaten their benchmarks by a big margin in some years, but equally many have significantly underperformed.

By contrast, the orange bars show the returns of index funds investing in shares, which are concentrated in a narrow band around the benchmark. Therefore an investor looking for predictable performance relative to the market has a greater chance of achieving this by investing in an index fund.

Index funds provide more predictable relative performance than active funds

Active funds experience a wider range of relative returns

Past performance is not a reliable indicator of future results.

Notes: The chart shows the range of returns (net of fees in GBP) of active and index European share funds available for sale in the UK relative to their primary prospectus benchmark for the 10-year period between 31 December 2013 and 31 December 2023. The orange bars show occurrences where an index fund may occasionally return more or less than the index. This is where the index price and fund net asset values (NAVs) are calculated at different times of the day and so the closing value of the index may temporarily deviate from the fund price.

Source: Vanguard calculations, using data from Morningstar.

2. Balance through diversification

Diversification (spreading your risk across different investment types like shares and bonds but also across shares in different regions and sectors) is key to achieving balance in your portfolio.

This is because only a small proportion of shares drive the performance of the market over time and it is hard to select these shares in advance. Our research shows that between 1 January 2014 and 31 December 2023, only 39% of shares in the FTSE All-Share index actually beat the benchmark5.

By owning an index fund that holds as many companies in the desired market as possible, investors don’t have to worry about trying to select the shares that will outperform (which, as we have seen, even professional fund managers struggle to do). With an index fund, investors can track the performance of that market as closely as possible.

3. Minimise costs

Costs can be a significant drag on investors’ returns over time. Index funds tend to have lower fees than active funds and our research indicates that the more a fund costs, the greater its chances of underperforming the market6.

The combination of an index fund’s predictable performance relative to its market index, and its lower costs, typically results in performance that is close to the benchmark it is tracking.

4. Maintain discipline

Vanguard’s final principle for investing success is discipline. In a nutshell, this is about sticking to an investment plan and reevaluating it regularly to make sure it still matches your goals.

Investing in a low-cost index fund can make it easier to stay the course because you have a better chance of closely tracking the market – although remember that the value of investments can rise as well as fall and you may still get back less than you invested.

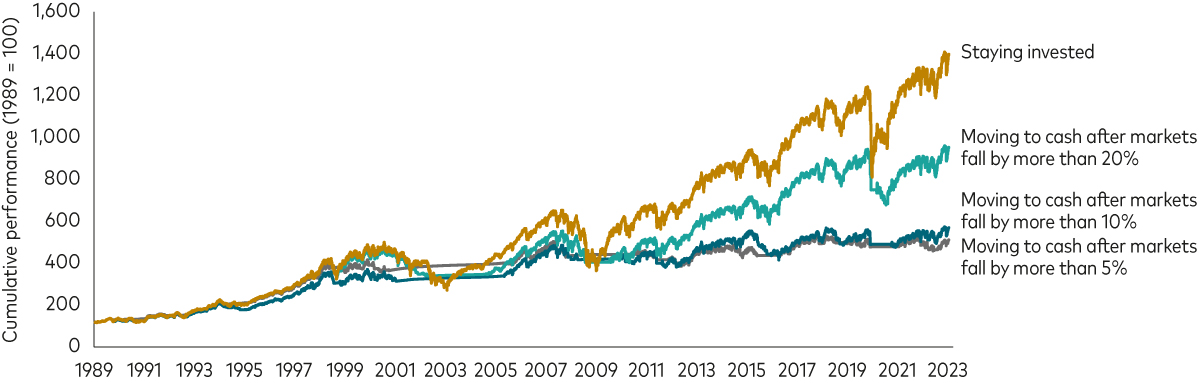

The chart below illustrates how staying invested during periods of market turbulence can have a big impact on the value of your portfolio. It shows four periods of market turbulence between January 1989 and December 2023: the Russian financial crisis in October 1998; the September 11 crisis and ending of the dot-com boom between September 2001 and January 2002; the global financial crisis (GFC) of September 2008 to September 2009 and the Covid-19 downturn from March to May 2020.

The chart shows what would have happened to the value of the investor’s portfolio in four different scenarios. In the first (dark grey line), they sell their investments and move fully to cash after the market falls by more than 5%; in the second (dark green line), the investor moves fully to cash after the market falls by more than 10%; in the third (light green line), the investor moves fully to cash after the market falls by more 20%; and, in the final scenario (orange line), the investor stays fully invested throughout the period of market turbulence. The investors who fled the market locked in losses and ended up with a lower portfolio value than the investor who remained invested throughout.

The importance of maintaining discipline

Selling and moving to cash for just a few months can lead to underperformance7

Past performance is not a reliable indicator of future results.

Notes: The chart shows the performance of the FTSE All-Share Index (an index of UK shares listed on the London Stock Exchange’s main market) and the impact of selling investments and switching fully to cash under various scenarios between 1 January 1989 to 31 December 2023. Each line tracks investors withdrawing to cash from the previous peak and remaining in cash as long as the cumulative drawdown (or market downturn), is below a threshold. Timing of entry and exit is assumed to occur at the close of the following business day. Cash is represented by the Bloomberg US Treasury 1-3 Months US Treasury Bill Index, which we use as a global proxy for cash returns. Returns are in nominal terms.

The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and capital value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost.

Source: Vanguard calculations using data from Rimes.

The four points above show why investing in low-cost index funds that closely track a market index can help to improve your chance of investment success.

1 31 August 1976.

2 With an active fund, an investment manager selects investments in accordance with the fund’s investment objectives, which may be to outperform relative to a benchmark index (see footnote below).

3 A benchmark is often a market index, or combination of indices, that investors use to measure investment performance. An index typically measures the performance of a basket of investments, such as a basket of shares or bonds, that are intended to represent a certain area of the market.

4 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

5 Total return (dividends reinvested) between 1 January 2014 – 31 December 2023. Source: Vanguard calculations, using data from Morningstar.

6 Lawrence, Stephen, Andrew Patterson and Marvin Ertl, May 2024, Considerations for index fund investing, Vanguard research.

7 The performance data shown represent past performance, which is not a guarantee of future results. Investment returns and capital value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Other important information

Vanguard Asset Management Limited only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.