Three reasons to keep a balanced portfolio

Find out how a balanced portfolio can help to manage risk, boost returns and improve your chances of long-term investment success.

When stock markets are turbulent, investing can feel unnerving. However, holding a balanced portfolio can help reduce stress and improve your chances of achieving long-term investment success.

Balance is one of our four investment principles and we believe it could have a bigger impact on your returns than anything else you do. What do we mean by balance? We’re talking about your asset allocation – how you divide your portfolio among different assets such as shares and bonds1.

In a previous article, we explained how your financial goals and attitude to risk are key when choosing which assets to invest in. But why is this so important? We explore three key reasons below.

1. Your asset allocation will determine your returns

Your asset allocation is one of the most important decisions you can make as an investor because it determines your risk and returns.

Shares offer higher potential returns over the long term but come with greater swings in prices. Bonds, on the other hand, are typically more stable but offer lower potential returns. The key to successful investing is getting this split right.

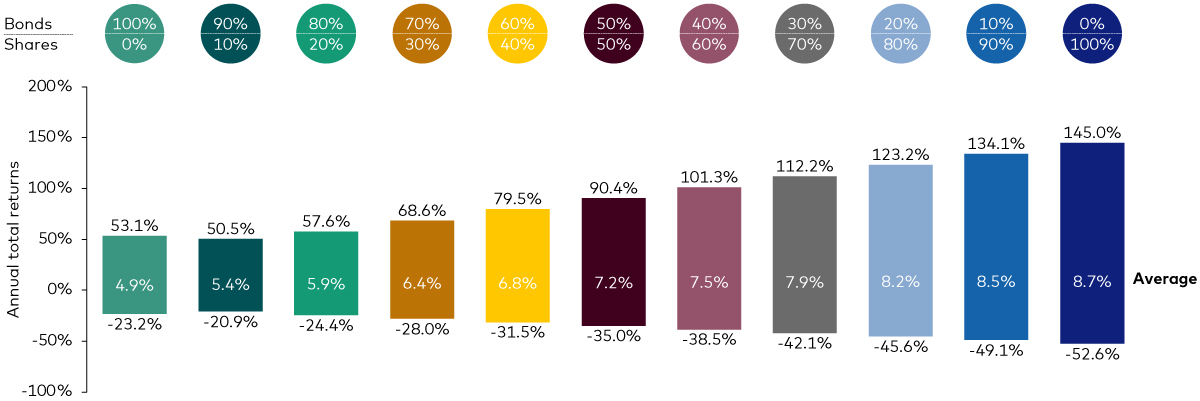

The chart below compares the returns of portfolios with different asset allocations. A portfolio with 100% shares (the dark blue bar) has an average annualised2 return of 8.7%, but the returns range widely from -52.6% up to 145%. A portfolio with 60% shares and 40% bonds (the dark pink bar) has a lower average annualised return of 7.5% but it also has a narrower range of returns from -38.5% to 101.3%.

The chart shows that while a portfolio with a greater proportion of shares can come with greater risk, the potential for reward is significantly higher than a portfolio with a higher exposure towards bonds. When you’re deciding where to invest, it’s important to consider the level of risk you’re comfortable with as well as the expected returns.

How a portfolio’s mix of shares and bonds affects risk and return

Past performance is not a reliable indicator of future results.

Notes: Reflects the maximum and minimum calendar year returns, along with the average annualised return, from 1901-2024, for various share and bond allocations, rebalanced annually. Shares are represented by the DMS UK Equity Total Return Index from 1901 to 1969; thereafter, shares are represented by the MSCI UK Total Return Index. Bond returns are represented by the DMS UK Bond Total Return Index from 1901 to 1985; the FTSE UK Government Index from Jan 1986 to Dec 2000 and the Bloomberg Sterling Aggregate Index thereafter. Returns are in sterling, with income reinvested, to 31 December 2024.

Source: Vanguard.

2. It helps you reach your goals

A balanced portfolio can help you achieve your financial goals, whether you’re saving for retirement, a home deposit or another long-term aim. By holding the right combination of shares and bonds, you can maintain enough risk to allow your portfolio to grow while keeping risk in check.

For example, if you’re investing for the long term, you may want to include more shares in your portfolio, such as 80% shares and 20% bonds or, for a more moderate portfolio, 60% shares and 40% bonds. Although shares can experience significant downturns in the short term, history shows that these fluctuations often smooth out over longer periods.

If your goals are shorter term or you prefer less risk, you should consider holding more bonds than shares.

You can adapt your portfolio as your circumstances change. For example, as you get closer to retirement, investing more in bonds and less in shares reduces the risk of a market downturn depleting your investments just before you need to access them.

3. It reduces emotional distress

Investing can be emotionally taxing, especially when markets experience sudden drops or prolonged periods of uncertainty. A balanced portfolio can act as a psychological buffer, helping you stay calm and focused on your long-term goals.

When the stock market takes a downturn, the value of your shares can fall sharply, causing anxiety and the urge to sell off your investments and lock in losses. It is notoriously difficult to time the markets successfully. If you sell your shares and then buy back into them when the outlook appears brighter, share prices will probably have already moved higher and you could have reduced your potential returns.

Having a balanced portfolio with the right mix of shares and bonds for you can help you avoid making impulsive decisions, such as selling low and buying high – a recipe for poor investment performance.

Imagine a scenario where the stock market falls by 20%. If you have a 100% shares portfolio, your entire investment could drop by 20%, which might be overwhelming. On the other hand, a 60% shares/40% bonds portfolio might only see a 11% decline, thanks to the stability provided by bonds. This smaller loss is easier to handle emotionally, allowing you to stick to your investment plan and ride out the storm.

It’s important to be aware that the mix of shares and bonds in your portfolio can change over time, so you might need to ‘rebalance’ your portfolio to get back to your original asset allocation.

Find out more about what rebalancing is and how it works.How Vanguard can help you achieve a balanced portfolio

Investing in the right mix of shares and bonds might seem complicated, but it doesn’t have to be. For example, we offer a managed service where we ask you a few questions about how you feel about risk and, based on those answers, select a portfolio of investments for you. We manage your portfolio so you don’t need to monitor the market or attempt to make complex investment decisions yourself.

Alternatively, you can build your own portfolio from our wide range of low-cost individual funds. Or you can keep things simple by picking one of our LifeStrategy funds or Target Retirement funds, which combine shares and bonds in one ready-made portfolio.

It’s all about selecting the option that you feel most comfortable with.

1 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

2Annualised returns show what an investor would earn over a period of time if the annual return was compounded (i.e. the investor earns a return on their return as well as the original capital).

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Vanguard Target Retirement Funds and Vanguard LifeStrategy®Funds may invest in Exchange Traded Fund (ETF) shares. ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Vanguard will manage your investments in the Managed ISA and Managed SIPP on your behalf. You will not be able to place trades on your own account.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4683644