Investing may seem complicated at times, but with the right principles it can be a manageable journey. Vanguard's investing principles, which include keeping costs low and maintaining balance and discipline, begin with thinking about your financial goals.

A financial or investment goal is essentially any plan investors have for their money. Many of us aspire to achieve a certain quality of life or fund a specific objective. Being explicit about your investment goals help you to turn aspirations into reality.

Your goal could be to have a comfortable retirement or fund a big purchase in the future such as a property, a child’s education or a personal project. Or it might be something less tangible, such as simply growing your wealth to ensure future flexibility or to create a sense of financial security.

But first, it’s crucial to balance your current financial needs with your future aspirations, ensuring that your goals are realistic and attainable. This could mean paying off any high-interest debt and ensuring you always have some emergency or contingency funds for example.

Goal constraints

Once you’ve thought about what your investment goal (or goals) might be, it’s important to be realistic and understand that you may face some constraints in reaching them.

For example, you could have multiple goals and so it may be challenging to prioritise them. In such cases, each goal needs to be accounted for, and compromises may need to be made; some goals may need to be put to the side so that others can be tackled first. This normally involves understanding how much you may be willing to give up now to achieve a goal in the future.

There is no one-size-fits-all plan for reaching your goals; they are unique to your situation, preferences and aspirations. But identifying and prioritising your financial intentions allows you to focus on what matters most.

Other constraints may include, but are not limited to, how much time you have to invest (your investment horizon), how much risk you’re willing to take (how comfortable you are with potential price fluctuations within your portfolio), how much you can invest initially and over time and when you might need access to your investments.

The power of saving and investing

The value any portfolio achieves over time is the sum of two elements: savings (the amount an investor puts into their portfolio) and investment returns (the changes in the value of those contributions over time). Much of the discussion about investment success tends to focus on investment returns, but both elements are crucial in reaching a goal.

While you may have no control over market movements, you do have some control over how much you save and spend. And once you’ve set your goals, it is important to understand both how much you need to save and how much you can expect the investment to grow over a given time horizon.

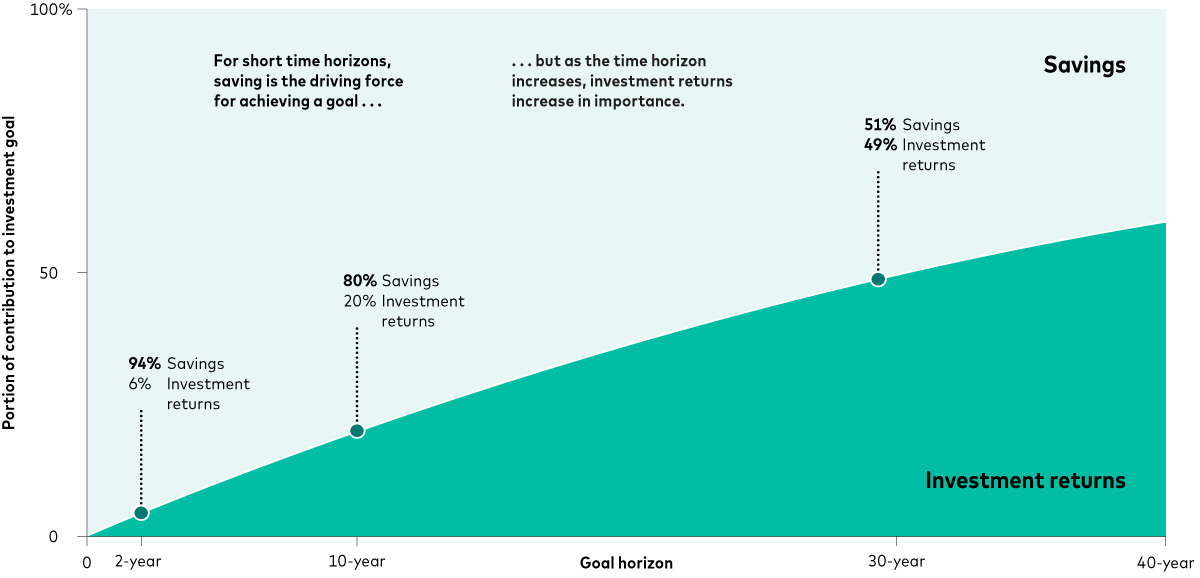

The chart below shows how time is a key factor here. For short time horizons, the amount you contribute (the pale blue section) is the driving force in achieving an investment goal. As the time horizon increases, investment returns (the green section) increase in importance.

It shows that for a goal with an investment horizon of two years, 94% of that goal is achieved through contributions, while only 6% comes from investment returns. If that horizon is expanded to 10 years, savings contribute only 80% toward the goal, with investment returns contributing the remaining 20%. Finally, over a 30-year time horizon, investment returns and savings contribute roughly the same amount.

Savings and investment returns both contribute to the achievement of any investment goal

Over any given time horizon, an investment balance is the sum of savings (the amount an investor puts into the investment portfolio) plus the investment returns on the total amount invested.

These projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Notes: The calculation for the contribution of savings and investment returns is as follows: Assuming a 4% real return (after inflation and costs), we calculate how much an investor needs to invest annually to achieve a given investment goal for different time horizons, varying from 0 years (now) to 40 years. Savings represent the amount invested (the capital). Contributions are assumed to be the same every year relative to the year investing begins.

Source: Vanguard.

This demonstrates that for long-term investment goals, the impact of investment returns becomes increasingly significant, highlighting the importance of both consistent saving and investing to maximise potential returns over time.

On the other hand, for shorter-term goals, the amount you contribute – which is within your control – may have a greater impact. Though remember, the value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

But whether its saving or investing or trying to fund a comfortable retirement or buying a new home, having a goal in mind can help when it comes to making the right choice for you.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

Vanguard Asset Management Limited only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management Limited. All rights reserved.