Regular investing involves making consistent contributions to your investment portfolio each month rather than making ad-hoc lump sum payments. This is a simple and effective way to build your wealth over time, even if you start with relatively small amounts.

Whether you’re investing for a specific goal or simply looking to grow your money, here are four reasons why regular investing can help you become a more successful investor.

1. A little goes a long way

One of the most powerful aspects of regular investing is a little can go a long way. By making consistent contributions over time, you can take full advantage of the power of compounding – when you earn returns on the money you invest as well as on the returns themselves.

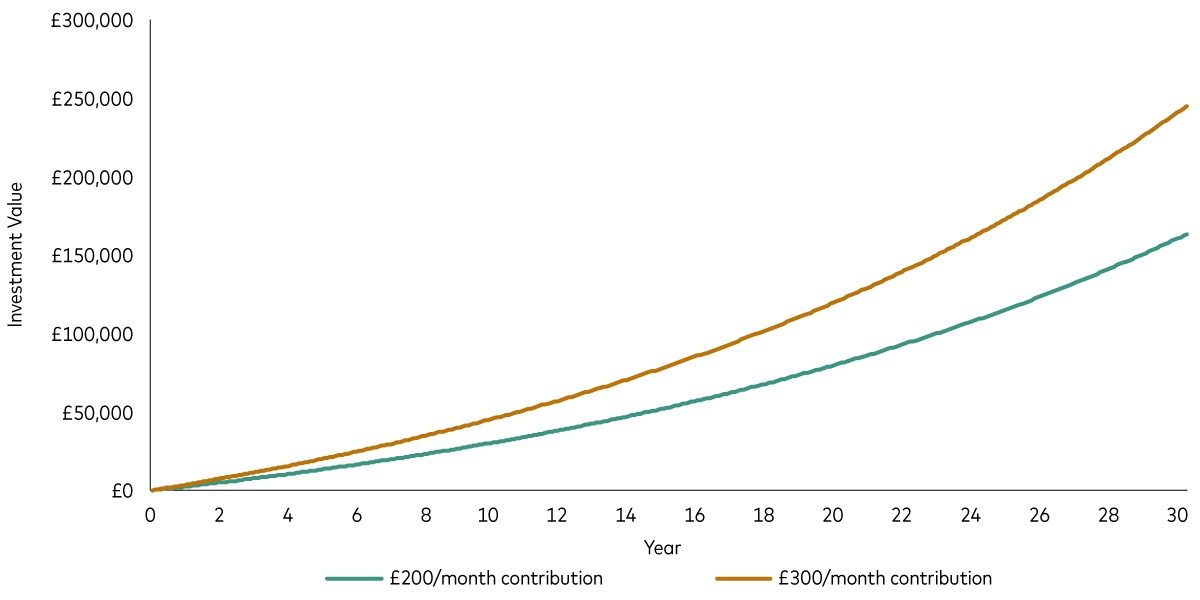

For example, the chart below shows that investing just £200 a month would give you £163,075 after 30 years, with around £90,000 of that from investment returns alone. This assumes an annual return of 5% after fees. Investing £300 a month would give you £244,612 over the same period, with around £137,000 from investment returns.

Regular contributions can make a big difference to your investments

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5% after fees. Balances reflect the value at the end of each period.

Source: Vanguard calculations.

With Vanguard you can set up a regular payment from as little as £100 a month. You may want to consider setting up the payment up shortly after payday, so it doesn’t feel like a huge expense. As you earn more money, you may also want to consider increasing your monthly contributions.

2. You avoid trying to time the market

By setting up a regular payment, you avoid the challenge of trying to time the market. Nobody can predict the best time to invest (not even the experts) because markets fluctuate frequently.

By investing a fixed amount on a fixed date every month, you take the guesswork out of investing and ensure your money is being put to work rather than sitting idle. It can also help you stay calm when markets fluctuate and is a strategy used by investors called ‘pound-cost averaging’.

Regular investing helps to even out fluctuations in share prices because you buy more shares when prices are low and fewer shares when prices are high. Over time, this can lead to a lower average cost per share.

Imagine you invest £100 every month. One month, you might get 10 shares at £10 each. The next month, if the price drops to £5, you’ll get 20 shares. So, you end up with an average cost of just £6.67 per share.

3. It saves you time

Setting up a direct debit to your investment account ensures you avoid the hassle of manually transferring funds each time. This not only saves you time but also makes it easier to stick to your strategy without the need for constant reminders.

It also means you’re less likely to be tempted to spend the money on impulse buys or unnecessary expenses, ensuring that your hard-earned cash is consistently allocated towards your long-term financial goals. This can help you build a more robust and resilient investment portfolio over time.

4. It can help you become a more disciplined investor

Regular investing fosters discipline, which is one of our four investment principles. It’s all about sticking to your investment plan and keeping it aligned with your goals or life stage.

When you commit to investing every month, you’re more likely to maintain a long-term perspective and avoid making impulsive decisions based on market news or personal emotions. This discipline helps you weather stock market volatility and stay focused on achieving your financial goals.

How to set up a regular payment with Vanguard

At Vanguard, you can set up a regular payment by logging into your account via our website or in our app. Simply select the product you want to set the payment up for, the date you want it to start (which must be at least 8 working days in the future), the amount and the investment you want to pay for.

If you want to amend your contribution, make sure any changes are made more than 8 working days before the next payment date.

By investing regularly, you’ll gradually build up your investments over time and are more likely to reach your goals faster.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4600737