Why you shouldn’t try to predict stock market movements

Trying to predict stock market movements is futile. Learn about volatility indices, their limitations and why investors should ignore short-term market noise.

When stock markets get rocky, you might see volatility mentioned in the news.

Volatility is a measure of how much the price of an asset, such as shares, fluctuates over a given period. When there’s a lot of volatility, it means prices are changing a lot and can be unpredictable. When there’s less volatility, prices are more stable.

For example, when the US announced tariffs in April, stock markets became very volatile. Share prices went up and down a lot, but they quickly settled back to normal levels.

But how important is volatility? Some tools, called volatility indices, reflect how much traders think the market will fluctuate over the next month. While these so-called sentiment indicators can be interesting, we think it’s important for long-term investors to ignore this kind of short-term noise.

Why? First, it’s almost impossible to accurately predict what the market will do from one day to the next. And second, it’s sometimes better to do the opposite of what the indicator might suggest.

As legendary investor Warren Buffett once said: “Be fearful when others are greedy and be greedy when others are fearful.” This means that when everyone else is excited and buying shares, it might be a good time to be cautious because prices might be inflated. But when people are scared and selling, it could be a great opportunity to buy.

In this article, we explain why volatility isn’t the best indicator for long-term investors.

What are volatility indices?

One of the most well-known volatility indices is the CBOE Volatility Index, or VIX. It is a measure of the expected volatility of the US stock market. It is sometimes called the fear index because it measures how concerned traders are about the US stock market over the next 30 days.

A higher VIX number means more fear and uncertainty, while a lower number means more calm.

It probably comes as no surprise that the VIX surged on 7 April, shortly after the US tariff announcements. Investors were nervous, and the index reflected that sentiment. Two days later the index had almost halved and a month later it was at historically normal levels.

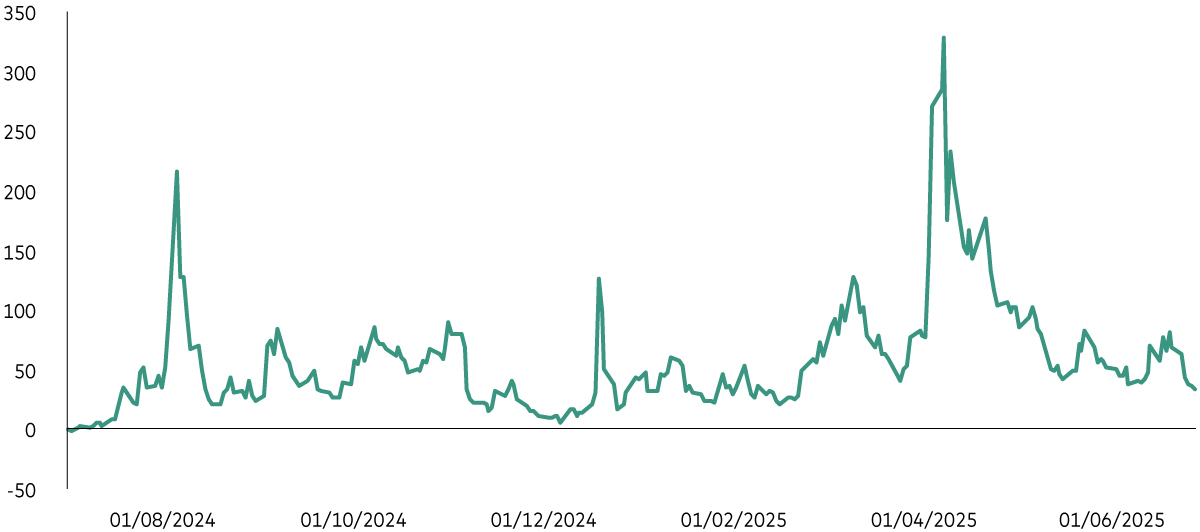

It’s important to note that the VIX is a gauge of short-term market fear. It reflects what traders are thinking in the moment but doesn’t provide any insight into the long-term prospects for shares. As you can see in the chart below, it can also rise and fall very quickly – usually in response to news headlines.

How the VIX has moved over the last year

Past performance is not a reliable indicator of future results.

Notes: The chart shows the CBOE Volatility Index from 30 June 2024 to 29 June 2025.

Source: Bloomberg and Vanguard as at 30 June 2025.

Does market volatility matter?

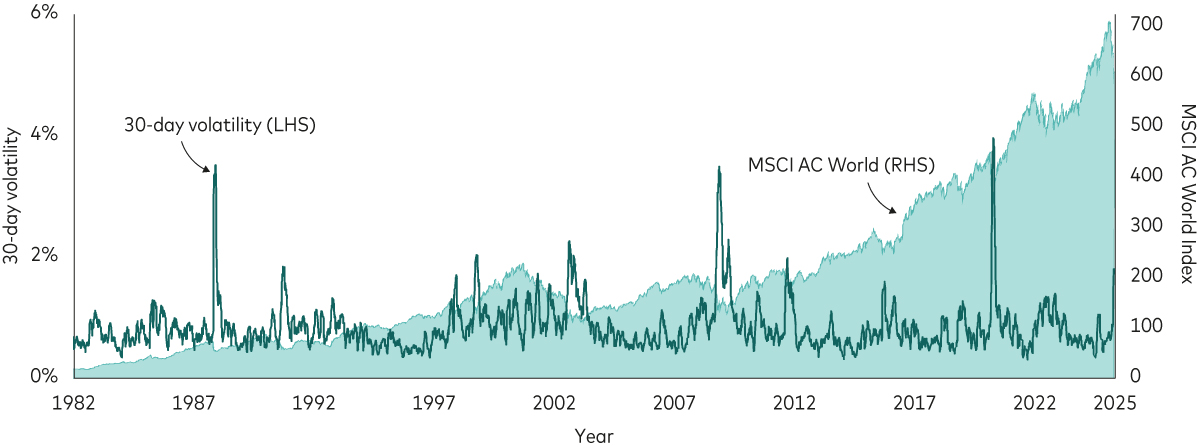

For long-term investors, volatility shouldn’t be a concern. History shows that while markets can be bumpy in the short term, they tend to grow over time.

In the chart below, the light-green line shows the performance of the MSCI World Index, which is an index comprising global shares, since 1982. The dark-green line shows the index’s actual volatility over the previous 30 business days.

Even though there were some periods of high volatility, which often coincided with market dips, the index climbed over the long term.

Don’t let volatility distract you – keep your focus on the long term

Past performance is not a reliable indicator of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: The light-green line shows the performance of the MSCI World Price Index from 1 January 1982 to 31 December 1987 and the MSCI AC World Price Index thereafter. The dark-green line shows the index’s price fluctuations (volatility) over the previous 30 business days. Even though there were times when volatility spiked, the market has grown over the long term.

Source: Vanguard calculations in GBP, based on data from Refinitiv, as at 20 April 2025.

What does this mean for you?

Market volatility can be scary and distracting, but it’s a normal part of investing. Successful investing is about having a solid plan and sticking to it, no matter what the market does in the short term.

If you’re a long-term investor, the key is to stay focused on your goals and not let short-term fears or excitement make you change your plan. Over time, the market tends to grow and your investments can benefit from this growth.

So, while volatility indices can be interesting to watch, they shouldn’t make you lose sleep. The best way to build wealth is to stay patient and consistent.

For more tips on how to navigate the market’s ups and downs with confidence, visit our market volatility hub.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4643508