As you approach retirement, it’s generally a good idea to start reducing the level of risk in your investment portfolio.

This is because the closer you get to retirement, the less time you have to recover from potential stock market downturns, which can significantly impact your savings.

However, an analysis of Vanguard clients1 found that many people approaching retirement may be taking on more risk than is typically advisable.

In this article, we explore why excessive risk could threaten your retirement and how to strike a balance between growth and security.

Clients approaching retirement are overexposed to risk

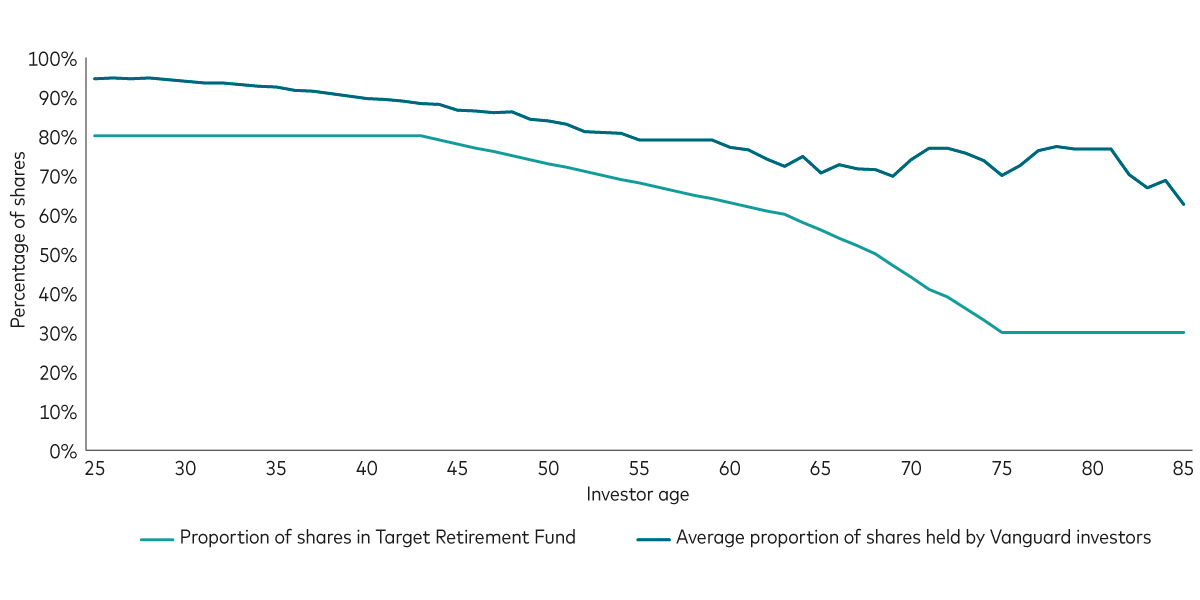

To understand how much investment risk our UK Personal Investor clients are taking on, we analysed the percentage of shares held by investors of different ages. A higher proportion of shares in a portfolio generally indicates a higher level of risk. While shares can offer higher potential returns, they also come with greater swings in prices. Bonds2, on the other hand, are typically more stable but offer lower potential returns.

Our analysis revealed that, on average, clients aged 50 held 84% of their portfolio in shares, while clients aged 60 held 77% in shares. Even clients aged 70 held 74% of their portfolio in shares.

These figures are significantly higher than the proportion of shares investors would hold if they invested in one of our Target Retirement Funds (TRFs), which automatically move you into less risky investments as you get closer to retirement. For example, someone aiming to retire at age 68 would hold 73% shares at age 50, 63% at age 60 and just 44% at age 70.

Age-based allocation to shares by Vanguard investors versus Target Retirement Funds

Source: Vanguard analysis of UK Personal Investor clients as at 7 February 2025.

We also looked at the proportion of shares investors would hold if they invested through our Managed Personal Pension, where we match you to a portfolio of funds based on both your attitude to risk and target retirement date. We found that clients aged 68 and over were, on average, holding a higher percentage of shares than they would in all our managed portfolios, even the ‘very adventurous’ portfolio.

Why excessive risk can threaten your retirement

There may be valid reasons why some clients maintain a relatively high level of risk as they approach retirement.

For example, some clients might be planning to pass their investments on to future generations, where the funds won’t be accessed for several more decades. This longer investing timeframe can allow for greater risk-taking because there is more time to recover from potential market downturns. Others may hold lower-risk investments with other providers, meaning their overall risk exposure isn’t as high as it appears. For example, they might plan to use their Vanguard portfolio for discretionary spending, dipping into it as and when they want, rather than relying on it for essential expenditure.

However, it’s important to remember that taking too much risk in the run-up to retirement could have serious consequences for your financial security. If a major stock market downturn occurs, a portfolio heavily weighted in shares could suffer substantial losses. You might need to continue working longer to rebuild your savings or accept a lower income during retirement.

On the other hand, a more balanced portfolio with a higher allocation to bonds can provide a buffer against market fluctuations, helping your retirement savings to remain more stable and reliable.

Taking on too much risk can also lead to emotional stress and poor decision-making. The fear of losing a significant portion of your savings may cause you to make impulsive decisions, such as selling investments at a loss. This can further complicate your financial situation and undermine your retirement goals.

Balancing growth and security in retirement

While it’s important to reduce risk as you approach retirement, it’s also crucial to remember that your money needs to last a long time.

With many people living well into their 80s and beyond, retaining at least some exposure to shares can help your money grow and keep pace with the rising cost of things like food, travel and energy. A completely risk-free portfolio might not generate the returns needed to sustain your lifestyle over a multi-decade retirement.

Finding the right balance between risk and reward is essential. By maintaining a balanced portfolio that includes a mix of shares and bonds, you can aim to achieve steady growth while minimising the risk of significant losses.

1 Vanguard analysis of UK Personal Investor clients as at 7 February 2025.

2 Bonds are a type of loan issued by governments or companies, which typically pay a fixed amount of interest and return the capital at the end of the term.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Eligibility to invest in a Vanguard Personal Pension depends on your individual circumstances. Please be aware that pension and tax rules may change in the future and the value of investments can go down as well as up, so you might get back less than you invested. You cannot usually access your pension savings or make any withdrawals until the age of 55, rising to the age of 57 in 2028.

If you are not sure of the suitability or appropriateness of any investment, product or service you should consult an authorised financial adviser. Please note this may incur a charge.

The Vanguard Target Retirement Funds may invest in Exchange Traded Fund (ETF) shares.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice.

Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Vanguard will manage your investments in the Managed SIPP on your behalf. You will not be able to place trades on your own account.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. The KIID for this fund is available, alongside the prospectus via Vanguard’s website.

The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC.

For investors in UK domiciled funds, a summary of investor rights can be obtained via https://www.vanguard.co.uk/content/dam/intl/europe/documents/en/Vanguard-InvestorsRightsSummaryUKFUNDSJan22.pdf and is available in English.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4406348