Even though it may feel unnerving to invest when markets are choppy, the start of the new tax year can be a good opportunity to make the most of your 2025-26 individual savings account (ISA) allowance.

You might be wondering what the hurry is, given that there are 12 months to go until the tax year ends. But when it comes to growing your long-term wealth, the data suggests it’s usually better to act sooner rather than later.

No time like the present

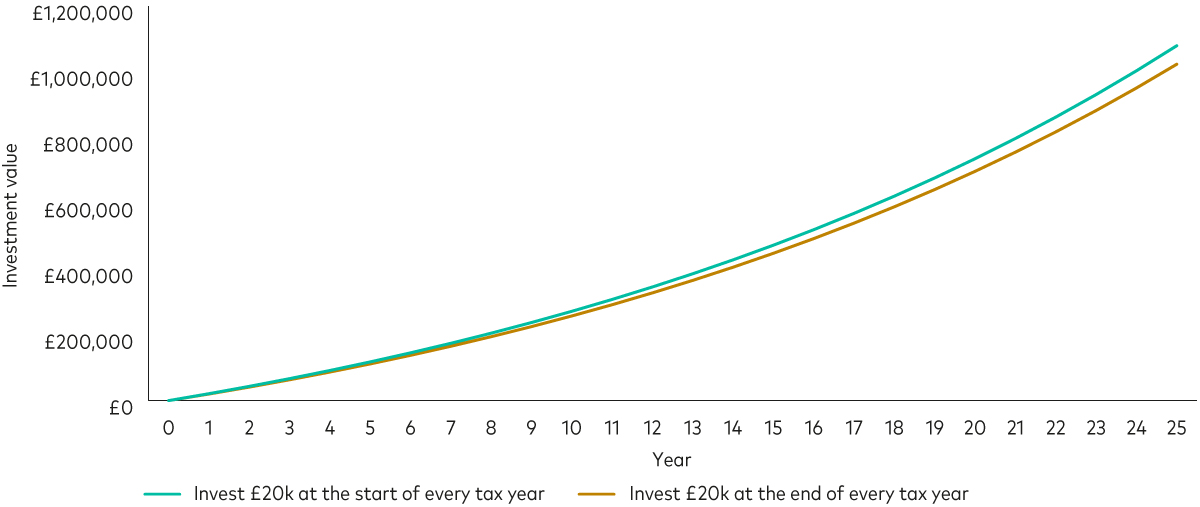

Our analysis shows that investing £20,000 (the current ISA allowance) at the start of each tax year can lead to a much larger pot of money compared with waiting until the end.

In our analysis, our hypothetical investor invests £20,000 on 6 April 2025, followed by an additional £20,000 at the start of every subsequent tax year. Assuming an annual return of 5.5% after fees, their investments would be worth £1,079,320 by the end of the 25th year.

But if they wait until the end of each tax year to invest (i.e. every 5 April starting from 2026), their pot would be worth £1,023,052 after 25 years – that’s around £56,000 less.

Investing at the start of the tax year versus the end

Notes: This hypothetical scenario is for illustrative purposes only and doesn’t represent a particular investment or its expected returns. It assumes annual returns of 5.5% after fees. Balances reflect the value at the end of each period.

Source: Vanguard calculations.

Invest early and often

Encouraging early and consistent investing aligns with our mission to give investors the best chance of investment success – and all the more so if it means taking advantage of legislation that is designed to save tax. When you invest through an ISA, you won’t pay income tax on the dividends1 or interest you receive, and you won’t pay capital gains tax on any profits you make when selling investments.

Of course, not everyone can invest £20,000 a year, let alone in one go. But if you have a lump sum of money that you don’t need for your emergency fund or short-term spending needs, why not put it to work in the market sooner? After all, it’s time in the market, not timing the market, that counts. While investments can go down as well as up and you may get back less than you invest, history shows that patient investors tend to be rewarded over the long term.

If you don’t have a lump sum, you could take advantage of the new tax year by setting up or increasing your regular investments. At Vanguard, you can set up a direct debit directly from your bank account, so you won’t forget to make a payment.

The power of compounding

One of the key reasons to invest early is that it gives you more time to benefit from compounding. This is when you earn returns on your returns as well as on the money you invest. This can help your investments to grow more quickly.

It’s like a snowball rolling downhill and it’s why, in our earlier example, our hypothetical investor earns an extra £56,000 by investing at the start of the tax year instead of at the end. You can learn more about this powerful concept in our article on compounding.

So, now that a new tax year has started, why wait until next April to invest? Those extra 12 months could make a big difference to your wealth in the long run.

1 Dividends are the payments some companies make to their shareholders out of their profits.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The eligibility to invest in either ISA or Junior ISA depends on individual circumstances and all tax rules may change in future.

Important information

Vanguard only gives information on products and services and does not give investment advice based on individual circumstances. If you have any questions related to your investment decision or the suitability or appropriateness for you of the product[s] described, please contact your financial adviser.

This is designed for use by, and is directed only at persons resident in the UK.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Asset Management Limited. All rights reserved.

4360253